🧵 Why $CYPR ( @Cypher_HQ_ ) is top tier quality exposure to the Neobank Meta:

Seeing funny comments on the TL about "stop chasing betas" and just hold $AVICI. NGMI mentality - the next trade is always the most important and if you're bullish on $AVICI you should be bullish on the entire meta as that's what will keep propelling the GOAT of this meta.

Many good threads out there on $CYPR, I don't want to regurgitate but I do think its nice to have a thread that compiles/ gives you bigger picture so you can find your own conviction bid

TLDR:

1/ $CPYR is one of the few "top 10 cards" (by deposits+spends) that has a token making it ez picking.

2/ Comps table (Doing 2.5x vol monthly than marketcap ((including more vol than $AVICI) )

3/ Catalysts: buybacks + x402 integration

4/ Investors are top tier

6/ Exchange listings and liquidity are coming (with such top tier investors/ connections wouldn't be a surprise to see T1 listings)

1/ There aren't many liquid opportunities in tokens to isolate crypto card exposure right now. Huge advantage for ez pickings.

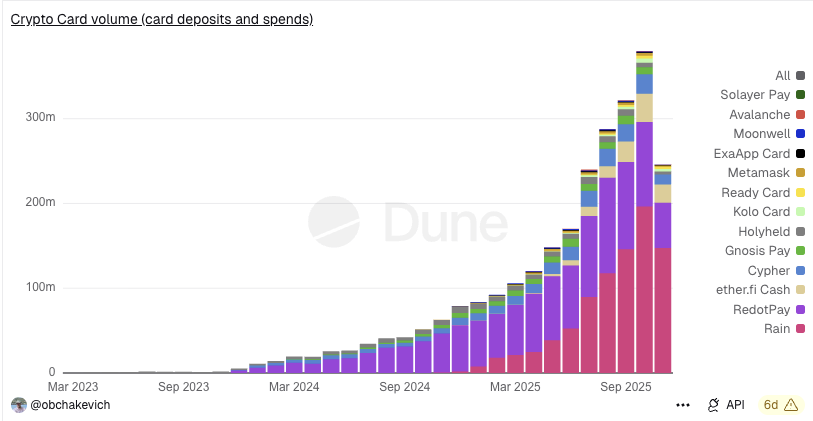

Lets take a look at the top 10 crypto cards on @DuneAnaIytics (courtesy of

@obchakevich)

***This dashboard combines both deposits + spends together***

1/ Only 4 of the TOP 10 Cards by volume have tokens ( $CYPR, $ETHFI, $AVICI, $GNO)

2/ Do you see the trade in the table?

$CYPR is an extreme outlier – volume is 2.4× the entire market cap in just one month ( previous months have also shown impressive traction)

This is the strongest reason why im extremely bullish - This isn't speculation which is so often what we price in crypto, but what's happening right now.

CYPR is completely undervalued on fundamentals and it's a very easy metric for degens to understand why which also greatly helps.

6/ Exchange listings and liquidity are coming (with such top tier investors/ connections wouldn't be a surprise to see T1 listings)

Lots in the pipeline to be excited about for

2,07 k

14

Le contenu de cette page est fourni par des tiers. Sauf indication contraire, OKX n’est pas l’auteur du ou des articles cités et ne revendique aucun droit d’auteur sur le contenu. Le contenu est fourni à titre d’information uniquement et ne représente pas les opinions d’OKX. Il ne s’agit pas d’une approbation de quelque nature que ce soit et ne doit pas être considéré comme un conseil en investissement ou une sollicitation d’achat ou de vente d’actifs numériques. Dans la mesure où l’IA générative est utilisée pour fournir des résumés ou d’autres informations, ce contenu généré par IA peut être inexact ou incohérent. Veuillez lire l’article associé pour obtenir davantage de détails et d’informations. OKX n’est pas responsable du contenu hébergé sur des sites tiers. La détention d’actifs numériques, y compris les stablecoins et les NFT, implique un niveau de risque élevé et leur valeur peut considérablement fluctuer. Examinez soigneusement votre situation financière pour déterminer si le trading ou la détention d’actifs numériques vous convient.