1/ EtherFi dominates LRTs with ~80% market share and 2.9M ETH (~$11.7B) TVL.

Less visible is its pivot toward a crypto neobank via Cash and Liquid strategies, which are scaling fast and now contribute materially to revenue.

Breaking down @ether_fi’s business:

2/ EtherFi launched in 2023 when Lido already controlled 30%+ of staked ETH, having built a durable moat around a thin-margin (5–10% net) and largely homogenous LST market.

Two structural tailwinds reshaped the landscape. The Shanghai upgrade provided the first, unlocking withdrawals and catalyzing new inflows into staking. EigenLayer created the second, and more powerful, tailwind by introducing restaking, allowing LRTs to earn base yield, restaking rewards, and Eigen points.

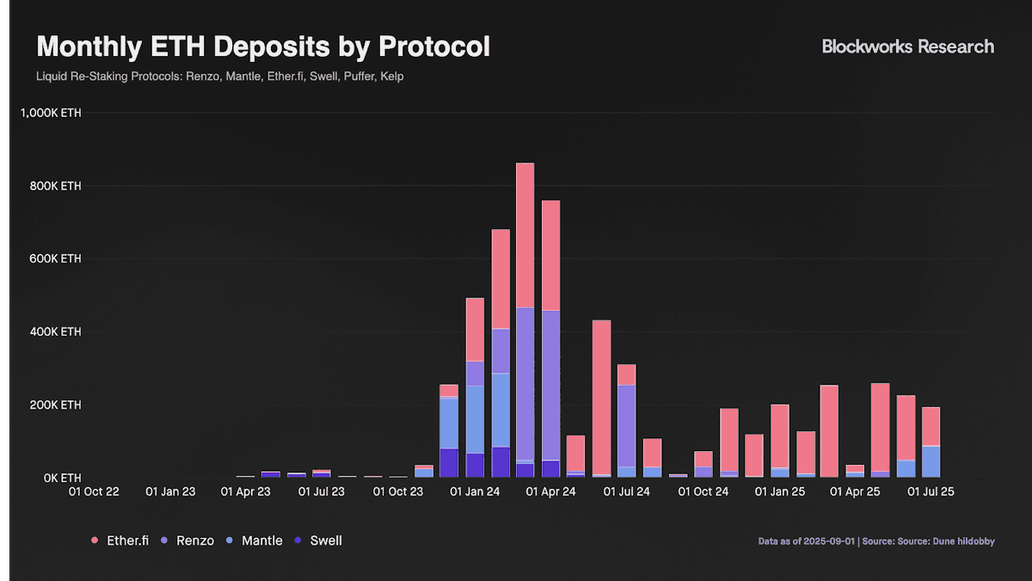

With ETH yield + Eigen points, new entrants layered on their own incentives, igniting LRT summer. At its peak more than 860k ETH was deposited into LRTs in a single month.

3/ However, points eventually had to be sold. Hype around LRTs mirrored DeFi farms of 2021, points delayed sell pressure until TGE, but once tokens launched, utility beyond yield was limited.

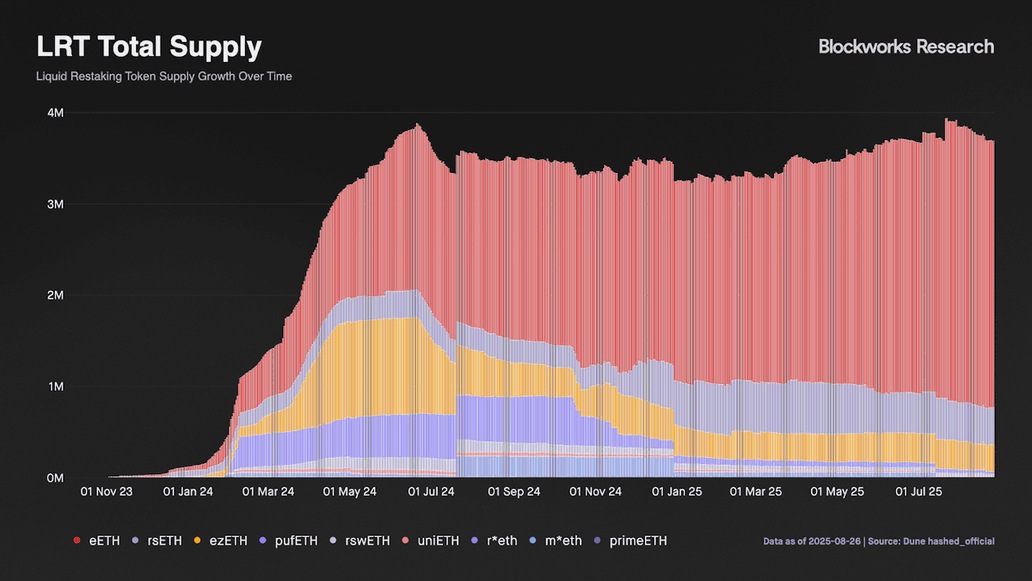

The “free lunch” ended and most LRTs collapsed or skipped TGE entirely. EtherFi stood out with its deep integrations on Pendle and Aave. eETH retained TVL even as LRT supply ex-eETH fell from 2M to <750k.

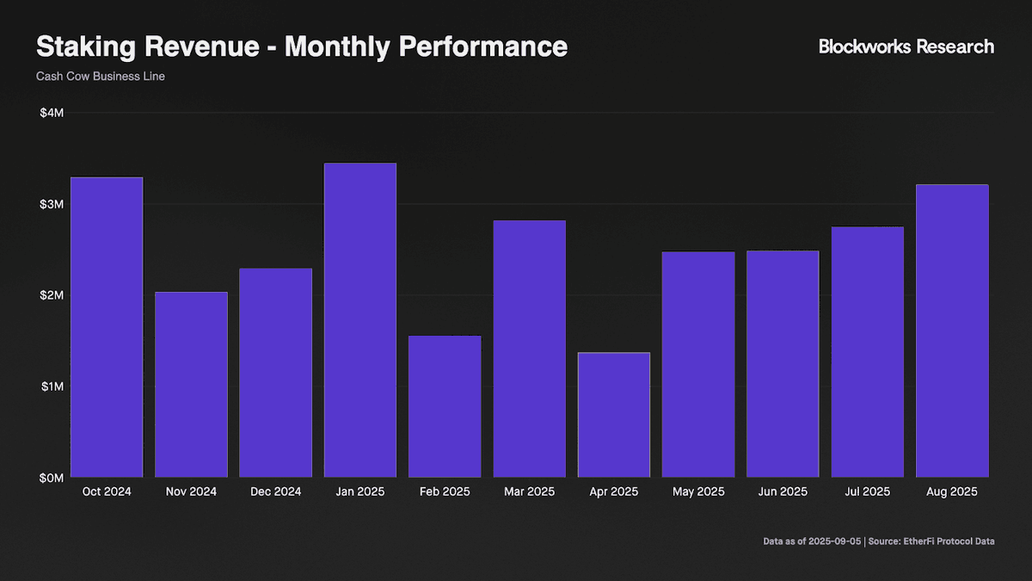

4/ With TVL being sticky, EtherFi’s LRT product became the core cash-cow line. Even at thin margins (10% on a ~2.7% APY), the scale drives outsized revenue.

YTD through Sept 15, 2025, staking produced $21.71M (~73% of revenue). Quarterly:

Q1: $7.7M

Q2: $6.4M (-17% QoQ)

Q3: $7.65M

5/ Despite its dominance, slowing growth and thin margins prompted expansion into Vaults and Cash.

The idea is to remove offramp friction and let a DeFi-integrated card use onchain assets as collateral at settlement, extending utility beyond staking and leveraging EtherFi’s distribution.

6/ EtherFi Cash has scaled quickly since launch. In 9 months it issued 11,280 cards and processed $38M across ~410k transactions; avg ticket is ~$93.

Cash revenue: $2.1M YTD, with $0.19M in Q1, $0.50M in Q2, and ~$1.90M in Q3 (projected) as adoption and card usage ramped. Cash feeds balances back into Vaults to keep funds productive onchain.

7/ EtherFi Vaults connect the ecosystem, keeping assets productive while still spendable via the Cash card. Users can deposit weETH, stables, or BTC into automated strategies.

Two advantages stand out:

• materially higher yields (~11% vs ~4% at neobanks)

• a negative effective borrowing cost, as yields offset the ~4% card borrow rate.

Vaults have generated $4.26M YTD (~14% of revenue), with $1.13M in Q1, $2.25M in Q2, and $0.88M in Q3 following a deliberate temporary fee decrease.

8/ YTD to Sept 15, revenue is $29.7M: Staking $21.7M (73%), Vaults $4.3M (14%), Cash $2.1M (7%), Withdrawals $1.6M (5%), Borrows $0.03M.

On a Q3 run-rate basis, mix shifts to Staking 66%, Cash 14%, Withdrawals 13%, Vaults 7%. QoQ growth of +$5.4M came from Staking (+$2.8M), Withdrawals (+$1.8M), Cash (+$1.6M), offset by Vaults (–$0.8M).

9/ Still, valuation sits closer to the LST cohort at roughly 24x P/S.

As Cash and Vaults scale with better margins than staking, the mix can improve if execution continues, which adds optionality beyond the core staking engine.

10/ For the full report with line-by-line details, growth vectors, projections, and the discussion on unlocks vs buybacks, see the full report from @blockworksres.

47.65K

128

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.