🪙 The era of BTC being king has arrived 🥇

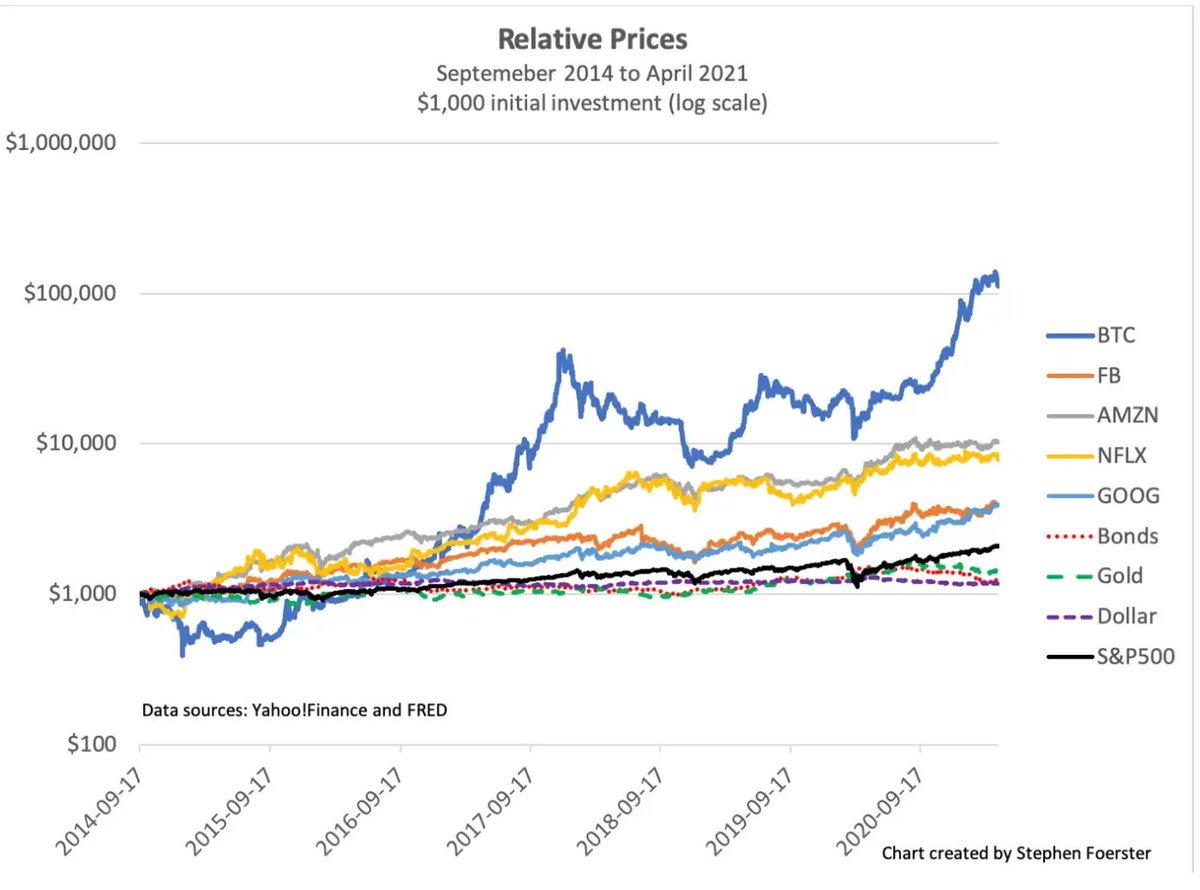

Over the past decade, #Bitcoin has been the best-performing asset, surpassing all other assets like gold, silver, the S&P 500, Nasdaq, and bonds.

The story of turning a thousand bucks into a hundred thousand bucks, only #bitcoin has done it first.

I remember back in 2017, I used fundamental analysis from traditional finance to study Bitcoin, when the price was $800 (the all-time high at that time!).

In a video from seven years ago, no more than three hundred people have seen my analysis 🥲

99.9% of investment assets, including cryptocurrency startup funds, have not outperformed Bitcoin.

Every person holding Bitcoin secretly hopes to own more.

So the core question is: how can one earn more Bitcoin?

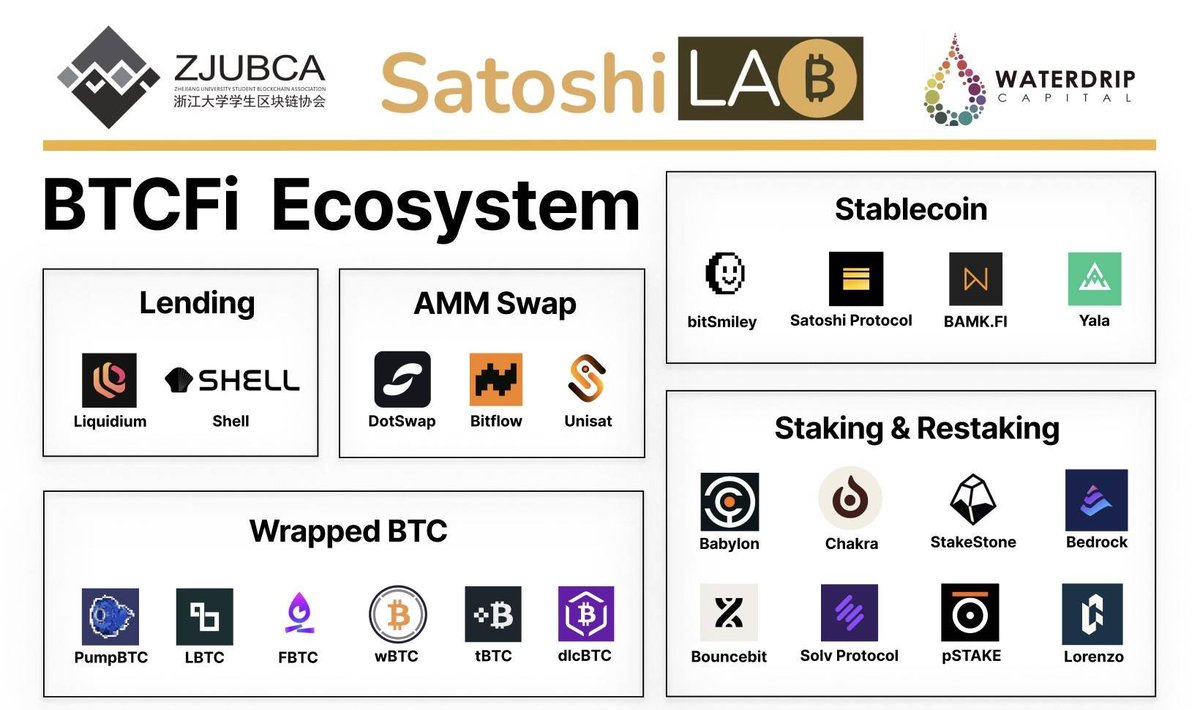

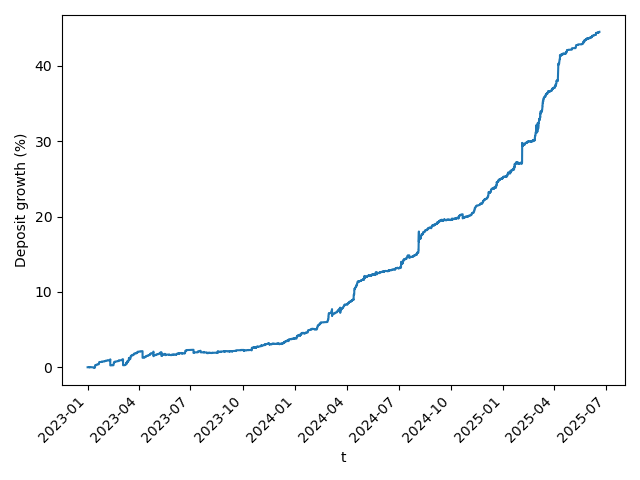

"BTC Yield" is born, belonging to the new ecosystem of BTCfi.

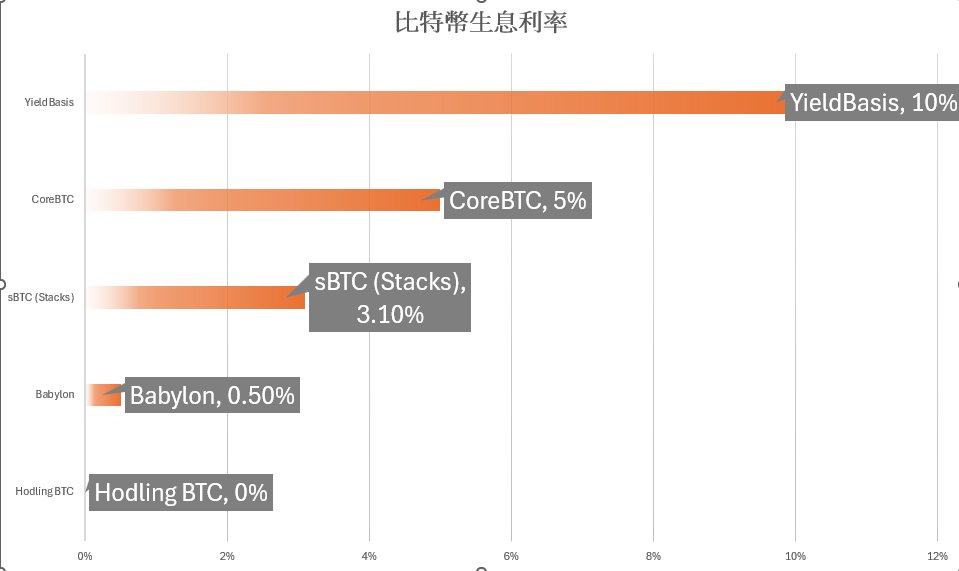

Bitcoin originally had no interest; how can you earn more Bitcoin by holding Bitcoin?

Here is my BTC Yield summary.

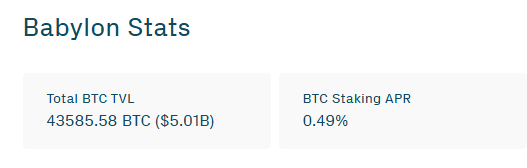

Player 1: Babylon Staking Protocol @babylonlabs_io

Babylon staking allows Bitcoin holders to stake directly on the Bitcoin network without needing to convert to other tokens or cross-chain. This process provides economic security for proof-of-stake (PoS) blockchains.

Earnings come from the native tokens issued by PoS blockchains that gain security through Bitcoin staking.

BTC Yield: 0.5%

Player 2: Stacks sBTC @Stacks

The sBTC mechanism of Stacks allows users to lock Bitcoin (BTC) on the Bitcoin mainnet and then mint 1:1 pegged sBTC tokens on the Stacks blockchain (BTC L2), enabling Bitcoin assets to participate in DeFi applications within the Stacks ecosystem. The earnings come from Stackers (participants who stake STX tokens) through Stacks' unique Proof-of-Transfer consensus mechanism, which earns Bitcoin rewards that are distributed to sBTC holders.

BTC Yield: 3.1%

Player 3: CoreBTC @Coredao_Org

CoreBTC is a Bitcoin-pegged token on the Core Chain, which operates by locking Bitcoin on the mainnet and minting an equivalent 1:1 CoreBTC on the Core Chain. This allows Bitcoin holders to participate in EVM-compatible smart contracts and DeFi applications, with earnings coming from the CORE token rewards obtained through participation in the Satoshi Plus hybrid consensus mechanism on the Core Chain.

BTC Yield: ~5%

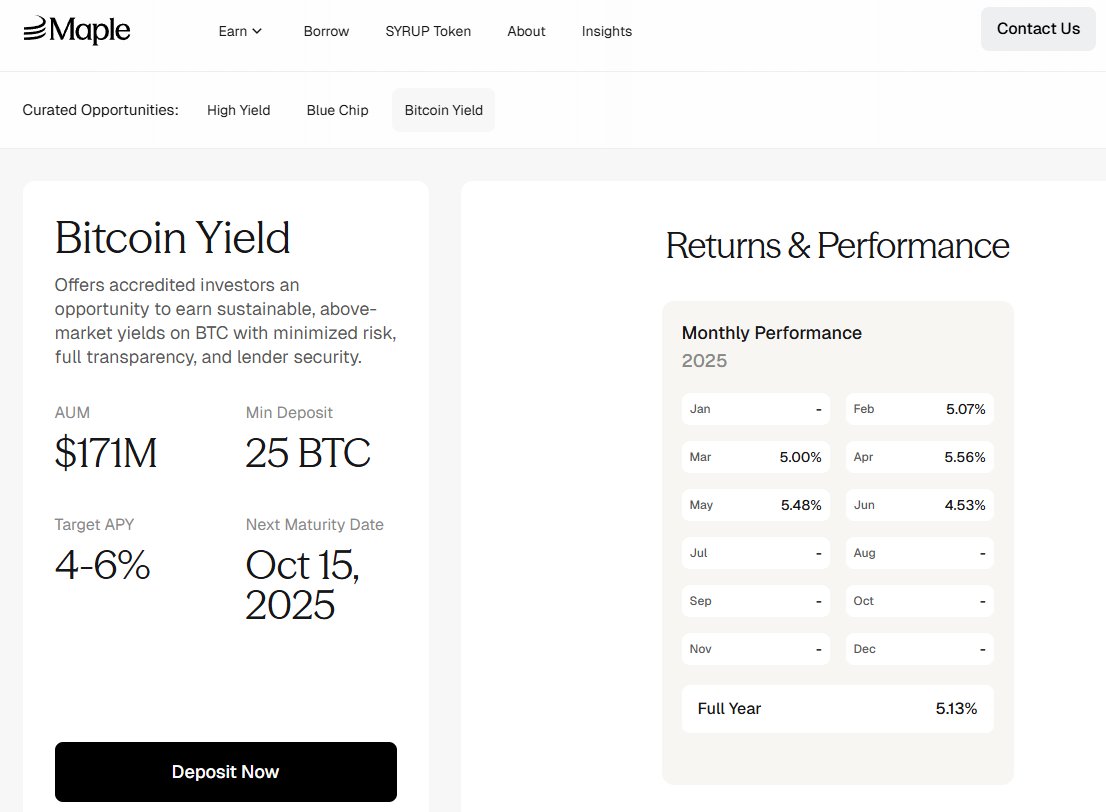

Player 4: Yieldbasis @yieldbasis

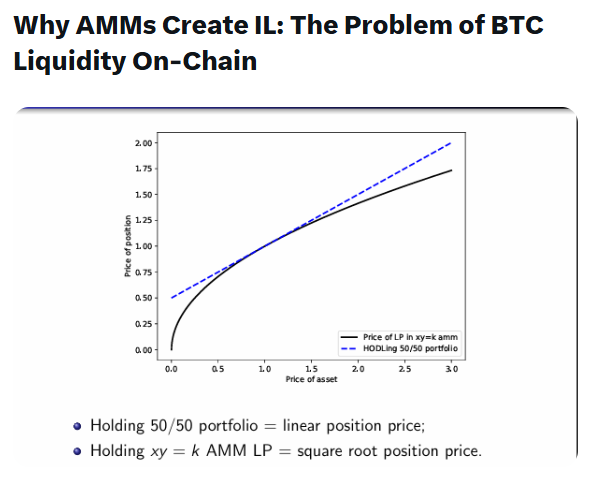

This is the DeFi project I am most looking forward to this cycle. Michael @newmichwill, the founder of Curve Finance, has come up with an incredible bridge that uses mathematical methods to solve the impermanent loss (IL) generated by current AMM-LP liquidity mining.

He discovered that by pairing BTC with crvUSD stablecoin as LP tokens, while maintaining a two-times leverage, the price of the LP tokens is equivalent to the price of Bitcoin. This means that the LP tokens eliminate impermanent loss in decentralized exchanges, while also allowing for earning trading fees (commission).

Historical backtesting shows a potential annual return of about 10%.

ybBTC: Your Bitcoin is now earning

This magical mechanism works as follows:

When you deposit BTC into YieldBasis, you will receive ybBTC—a Bitcoin that generates yield, representing your LP position in the BTC/crvUSD pool, whose value will grow over time. Behind the scenes, the protocol creates a complex liquidity position that can:

Maintain a 1:1 BTC exposure through dynamic rebalancing

Utilize leveraged liquidity to eliminate impermanent loss

Earn trading fees through BTC/crvUSD swaps

Automatically compound without any action required.

YieldBasis offers two different pathways to meet the diverse needs of users:

For those seeking simplicity and pure Bitcoin-denominated returns, directly holding ybBTC is the most straightforward choice. This way, you will automatically accumulate a proportional share of the trading fees generated by the BTC/crvUSD pool. Over time, these accumulated fees will appreciate your ybBTC assets relative to BTC, thus directly paying out returns in the form of Bitcoin. This is the most passive way to earn BTC returns within YieldBasis.

Staking ybBTC to obtain YB issuance.

For users willing to actively participate in protocol governance and potentially earn additional rewards, staking your ybBTC provides an alternative. When you stake your ybBTC, you will forgo direct receipt of trading fees. In exchange, you will begin to earn a certain proportion of YB token issuance, which is the native governance and reward token of the YieldBasis protocol.

By locking your YB tokens in veYB (vote-escrowed YB), you will be entitled to a share of the protocol management fees. This fee is part of the total trading fee revenue of the protocol.

10.52K

8

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.