we got so much shit for doing this with mSOL/SOL two years ago, and now it's standard practice.

where are the critics now?

13/ Coming back to USDe, Aave recently made two key architectural decisions that enabled the USDe loop strategy to thrive.

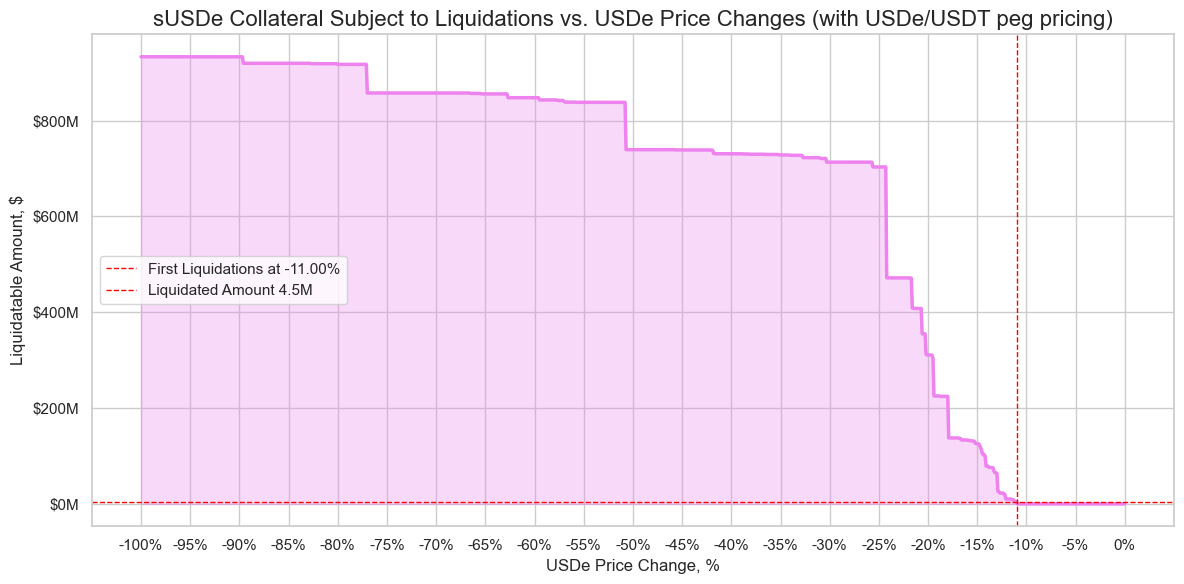

Firstly, after risk providers highlighted significant liquidation risks for sUSDe lenders due to potential price depegs, Aave DAO pegged USDe directly to USDT's exchange rate.

This decision eliminated the primary risk factor of liquidations, leaving only standard interest rate risk inherent in carry strategies.

@macbrennan_cc

8.58K

32

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.