Foxconn of stablecoins: foundries of trillions of stablecoins in the future

Title image source: Modern Times (1936)

Text: Sleepy.txt

Bridge, a stablecoin issuance platform owned by Stripe, one of the world's largest online payment infrastructures, has launched a native stablecoin for MetaMask, a wallet application with more than 30 million crypto users MetaMask USD(mUSD)。

Bridge is responsible for the full issuance process, from reserve custody and compliance audits to smart contract deployment, while MetaMask focuses on polishing the front-end product interface and user experience.

This cooperation model is one of the most representative trends in the current stablecoin industry, and more and more brands are choosing to outsource the complex issuance process of stablecoins to professional "foundries", just like Apple handed over the production of iPhones to Foxconn.

Since the birth of the iPhone, Foxconn has been taking on core production tasks almost constantly. Today, about 80% of the world's iPhones are assembled in China, and more than 70% of them come from Foxconn's factories. Zhengzhou Foxconn once accommodated more than 300,000 workers during the peak season, known as the "iPhone City".

– >

– >

Apple's cooperation with Foxconn is not a simple outsourcing relationship, but a typical case of the division of labor in modern manufacturing.

Apple focuses its resources on the user side, such as design, system experience, brand narrative and sales channels. Manufacturing does not constitute a differentiating advantage for it, but means huge capital expenditure and risk. Therefore, Apple never had its own factory, but chose to leave production to professional partners.

Foxconn has established core capabilities in these "non-core" links, building production lines from scratch, managing raw material procurement, process flow, inventory turnover and shipment rhythm, and continuously reducing manufacturing costs. It establishes a complete set of industrial processes in terms of supply chain stability, delivery reliability and capacity flexibility. For brand customers, this means the underlying guarantee of zero-friction expansion.

The logic of this model is division of labor and collaboration. Apple does not have to bear the fixed burden of factories and workers, and can avoid creating risks when the market fluctuates; Foxconn, on the other hand, relies on scale effects and multi-brand capacity utilization to extract overall profits from extremely low single profits. The brand focuses on creativity and consumer reach, and the foundry undertakes industrial efficiency and cost management, forming a win-win situation.

This is not just changing the smartphone industry. Since the 2010s, computers, televisions, home appliances and even automobiles have gradually moved towards the OEM model. Foxconn, Quanta, Wistron, Jabil and other manufacturers have become key nodes in the restructuring of the global manufacturing industry. Manufacturing is modularized and packaged into the ability to operate and sell at scale.

More than a decade later, this logic began to be transplanted to a seemingly unrelated field: stablecoins.

On the surface, issuing a stablecoin only needs to be minted on-chain. But to really make it work, the work involved is far more complex than the outside world thinks. Compliance framework, bank custody, smart contract deployment, security audit, multi-chain compatibility, account system access, and KYC module integration require long-term investment in financial strength and engineering capabilities.

We have written in the article "How much does it cost to issue a stablecoin? This cost structure is dismantled in detail: If an issuer starts from scratch, the initial investment is often in the millions, and most of them are incompressible rigid expenses. After launch, the annual operating cost may even reach tens of millions, covering various modules such as legal, auditing, operation and maintenance, account security and reserve management.

Today, some companies are beginning to package these complex processes into standardized services that provide plug-and-play solutions to banks, payment institutions, and brands. They may not necessarily appear in front of the stage themselves, but behind a stablecoin issuance, they can often be seen.

In the world of stablecoins, Foxconn has also begun to appear.

In the past, the"Foxconns" of the stablecoin world

wanted to issue a stablecoin, which almost meant playing three roles at the same time: financial institutions, technology companies, and compliance teams. The project team needs to negotiate with the custodian bank, build a cross-chain contract system, complete compliance audits, and even deal with licensing issues in different jurisdictions. For most companies, this is too high.

The emergence of the "foundry" model is to solve this problem. The so-called "stablecoin foundry" refers to an organization that specializes in providing stablecoin issuance, management, and operation services for other companies. They are not responsible for building an end-facing brand, but rather provide the complete set of infrastructure needed behind the scenes.

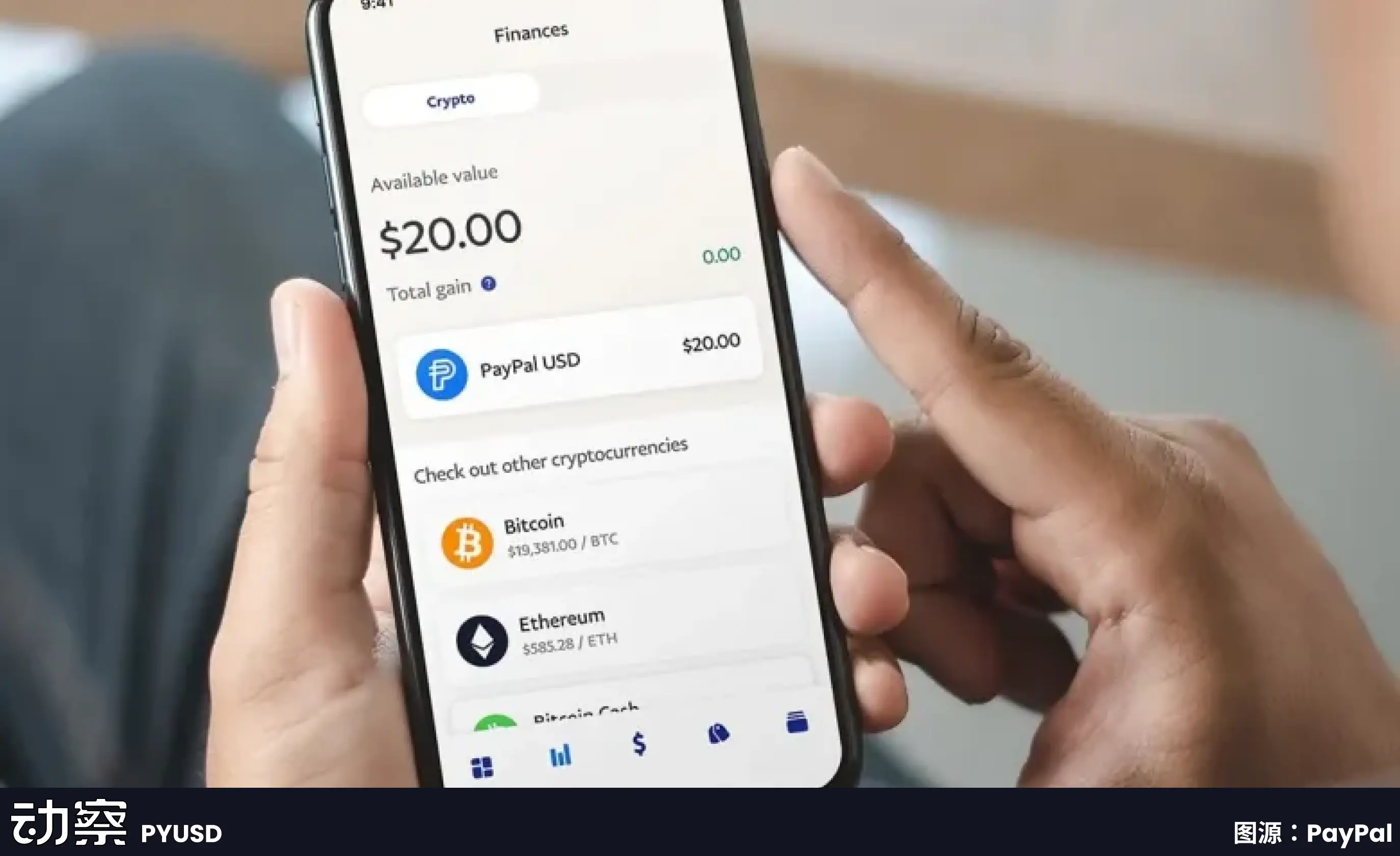

These companies are responsible for building a complete infrastructure from front-end wallets and KYC modules to back-end smart contracts, custody, and auditing. Customers only need to clarify which currency to issue and which markets to launch on, and other links can be completed by the foundry. Paxos played such a role when partnering with PayPal to issue PYUSD: custody US dollar reserves, responsible for on-chain issuance, and compliant docking, while PayPal only needs to display the "stablecoin" option in the product interface.

The core value of this model is reflected in three aspects.

The first is to reduce costs. If a financial institution wants to build a stablecoin system from scratch, the upfront investment can often be millions of dollars. Compliance licensing, technology research and development, security audits, and bank cooperation all need to be invested separately. By standardizing the process, foundries can reduce the marginal cost of a single customer to a much lower level than the self-built model.

The second is to shorten the time. The launch cycle of traditional financial products is often measured in "years", and if stablecoin projects take a completely self-developed path, it is likely to take 12-18 months to implement. The foundry model allows customers to launch products in a matter of months. The co-founders of Stably have publicly stated that their API access model allows a company to launch a white-label stablecoin in a matter of weeks.

The third is to transfer risks. The biggest challenge for stablecoins is not technology, but compliance and reserve management. The U.S. Office of the Comptroller of the Currency (OCC) and the New York State Department of Financial Services (NYDFS) have extremely strict regulatory requirements for custody and reserves. For most companies looking to test the waters, it's not realistic to take on full compliance responsibilities. Paxos was able to win over major customers such as PayPal and Nubank precisely because it holds a New York State trust license, which allows it to legally hold US dollar reserves and bear regulatory disclosure obligations.

Therefore, the emergence of stablecoin foundries has changed the entry threshold of the industry to a certain extent. The high upfront investment that only a few giants could afford can now be spun off, packaged, and sold to more financial or payment institutions in need.

Paxos: Turning processes into products and compliance into business

Paxos' business direction was set very early. It does not emphasize branding, nor does it pursue market share, but builds capabilities around one thing: turning the issuance of stablecoins into a standardized process that others can choose to purchase.

Thestory begins in New York, where in 2015, the New York State Department of Financial Services (NYDFS) opened digital asset licenses, making Paxos one of the first licensed limited purpose trust companies. That license plate is not just symbolic, it means that Paxos can hold customer funds, operate blockchain networks, and perform asset settlements. This kind of qualification is not available to many companies in the United States.

In 2018, Paxos launched the USDP stablecoin, and the entire process is placed under the regulatory vision: reserves are placed in banks, audits are disclosed monthly, and minting and redemption mechanisms are written on-chain. Not many people have learned this approach because of the high cost of compliance and the lack of speed. But it does form a clear and controllable structure, breaking down the birth process of a stablecoin into several modules that can be standardized.

Later, instead of focusing on promoting its own coins, Paxos packaged this module into a service for others to use.

There are two of the most representative customers: Binance and PayPal.

BUSD is a stablecoin service provided by Paxos for Binance. Binance controls the brand and traffic, while Paxos assumes issuance, custody, and compliance responsibilities. This model worked for several years until 2023, when the NYDFS demanded that Paxos stop new minting, citing inadequate anti-money laundering reviews. After this incident, the outside world began to notice that BUSD was issued by Paxos behind it.

A few months later, PayPal launched PYUSD, and the issuer was still Paxos Trust Company. PayPal has users and a network, but it has no regulatory qualifications and does not plan to build it itself. Through Paxos, PYUSD can be legally and compliantly listed and enter the US market. This is one of the most representative demonstrations of Paxos' "foundry" capabilities.

its pattern is also being replicated overseas.

Paxos has obtained a major payment institution license from the Hong Kong Monetary Authority (MAS) in Singapore and has issued the stablecoin USDG based on this. This is the first time Paxos has completed the entire process outside of the United States. It also set up Paxos International in Abu Dhabi to do overseas business and launched the yield-bearing US dollar stablecoin USDL, using local licenses to avoid US regulation.

The purpose of this multi-jurisdictional structure is very straightforward: different customers and different markets need different compliance and landable issuance paths.

Paxos hasn't stopped issuing it. In 2024, it launched a stablecoin payment platform, began to undertake corporate collection and settlement business, and also participated in the construction of the Global Dollar Network, hoping to connect stablecoins in different brands and systems to open up clearing. It wants to provide a more complete back-office infrastructure.

But the closer you get to regulation, the easier it is to be picked by supervision. The NYDFS has named its lack of anti-money laundering due diligence in the BUSD project. Paxos was also fined and required to file a corrective action. Although this is not a fatal blow, it shows that Paxos' path is not destined to be lightweight, and there is no room for ambiguity. It can only continue to thicken compliance and draw clear boundaries. It turns every regulatory requirement and every safety link into a part of the product process. When others use it, they only need to hang the brand to issue stablecoins. Paxos takes over the rest. This is its positioning, and it is also a business method that is deeply bound to technology and regulation.

Bridge: The addition of Bridge, a heavyweight foundry brought by Stripe

, has allowed a real giant to emerge in the stablecoin foundry track for the first time.

It was acquired in February 2025 by Stripe, one of the world's largest online payment infrastructures, processing hundreds of millions of transactions daily and serving millions of merchants. Compliance, risk control, and global operations, these paths that Stripe has already run, are now ported on-chain through Bridge.

– >

– >

Bridge is positioned directly to provide complete stablecoin issuance capabilities for enterprises and financial institutions. It is not simply technical outsourcing, but more like modularizing the mature links of the traditional payment industry and encapsulating them into standardized services. Reserve hosting, compliance audits, and contract deployment are all managed by Bridge, and customers only need to call the interface to access the stablecoin function in the front-end product.

MetaMask's collaboration case is the most illustrative. As one of the world's largest Web3 wallets, it has over 30 million users but lacks financial licenses and qualifications for reserve management. With Bridge, MetaMask can launch mUSD in a matter of months, rather than spending years building a compliance and financial system.

The business model chosen by Bridge is platform-based. It is not tailored to a single customer, but to build a standardized distribution platform. The logic is consistent with Stripe's approach to payments, lowering the barrier to entry through APIs and allowing customers to focus on their core business. Back then, countless e-commerce and applications were connected to credit card payments, and now companies can issue stablecoins in a similar way.

Bridge's strength comes from the parent company. Stripe already has a global network of compliance partnerships, which has made it easy for Bridge to enter new markets. At the same time, Stripe's built-in merchant network also constitutes a natural potential customer base. For those businesses that want to try their hand at the stablecoin business but lack on-chain technology or financial qualifications, Bridge offers a ready-made solution.

But limitations also exist. As a subsidiary of a traditional payment company, Bridge may be more conservative than crypto-native enterprises and may not iterate fast enough. In the crypto community, Stripe's brand influence is also far less than in the mainstream business world.

Bridge's market is more geared towards traditional financial and corporate clients. MetaMask's choice illustrates this, and it requires a trusted financial partner, not just a technology provider.

The entry of Bridge means that the stablecoin foundry business is being paid attention to by traditional finance. As more players with similar backgrounds join, the competition in this track will be more intense, but it will also promote the industry towards maturity and standardization.