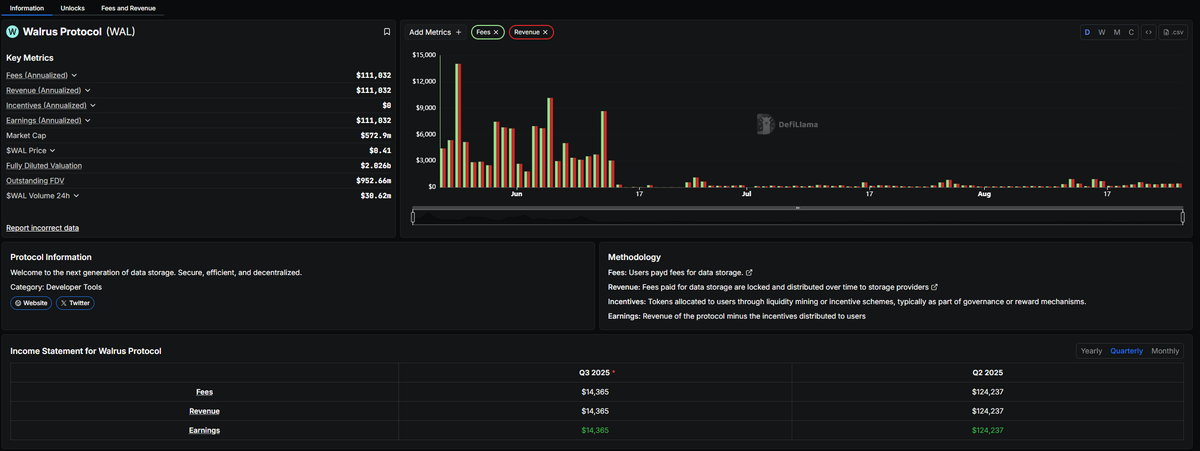

While looking into the momentum, I also took a look at the data from @WalrusProtocol in the SUI ecosystem on DefilLama.

Yesterday, I found that most of the related data was staked concerning the $WAL token. This could be seen as an induced environment due to the rewards from staking (such as airdrops), and since it is being utilized in PoS, the streaming of rewards cannot be overlooked.

So, how much money does this Walrus make as a service in the cloud?

Overall, the fees and revenue were high in June, but since June 15, it has hit a bottom and is moving at a similar level.

Looking at the monthly fee income and revenue, it can be seen that the fees and revenue are being equated, and it has dropped to about 1/8 of the level since May.

This seems to be one reason for the decrease in income, either because more incentives were distributed to users or because there are fewer projects storing data.

Is there anyone who knows why the fee income has decreased so significantly since June 15?

Charizard withdrew BTC from @MMTFinance and did the bridging, but I still haven't received it. Wouldn't it be better to just cancel the bridging and put it back into Momentum to at least mine it?

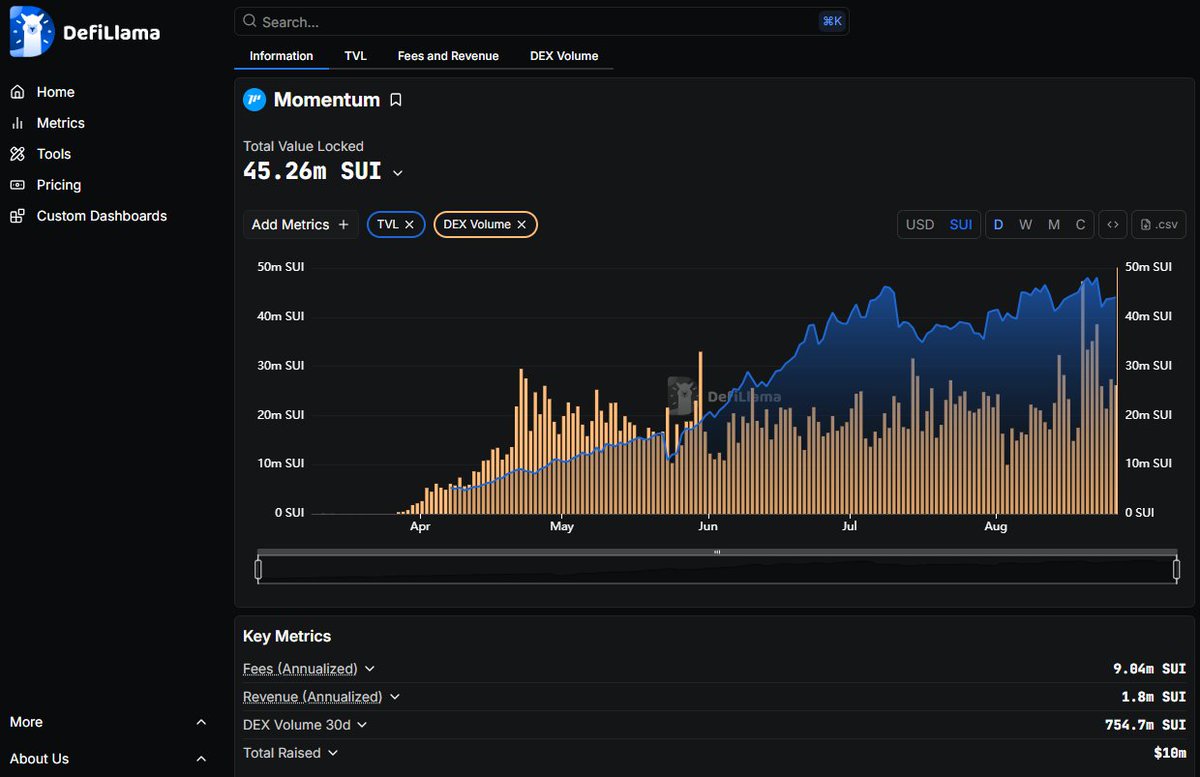

I often use DefilLama, one of the sites I frequently visit, if the project has on-chain data. I search for the project there and look at both TVL and Volume together.

Looking at Momentum, you can see that it peaked in TVL in July and has been fluctuating around a similar level since then. (The chart itself was created based on SUI.)

As for the volume, it has maintained a similar level since May, when the TVL wasn't high, with occasional peaks appearing in between.

Regarding the Fee section right below, which is the platform's revenue part, there were no fees in Q1 since it hadn't started yet, and you can see that the fees have grown in Q3 compared to Q2.

For reference, the revenue part doesn't all go to the platform as fees; it is given to liquidity providers, which is why there is a difference in the actual revenue part.

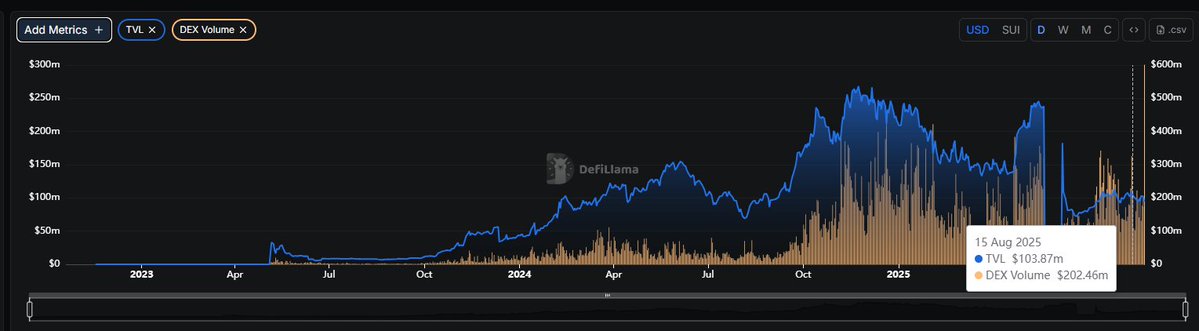

In terms of competing projects within Sui, the largest one, Cetus, has about a 60M difference in TVL, yet you can see that Cetus's volume is significantly higher compared to its TVL than Momentum's. This indicates that there is a difference in quarterly fee revenue or sales. This shows that Momentum still needs to pay more attention to trading activation.

8.59K

4

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.