$MORPHO: Outperforms with Explosive Growth Ahead of v2

- One of the few majors in line with the +10% market rally over 24H, but a clear leader with +30% returns over the last 7D. Trading at an FDV of $2.7B, up ≈94% since last coverage.

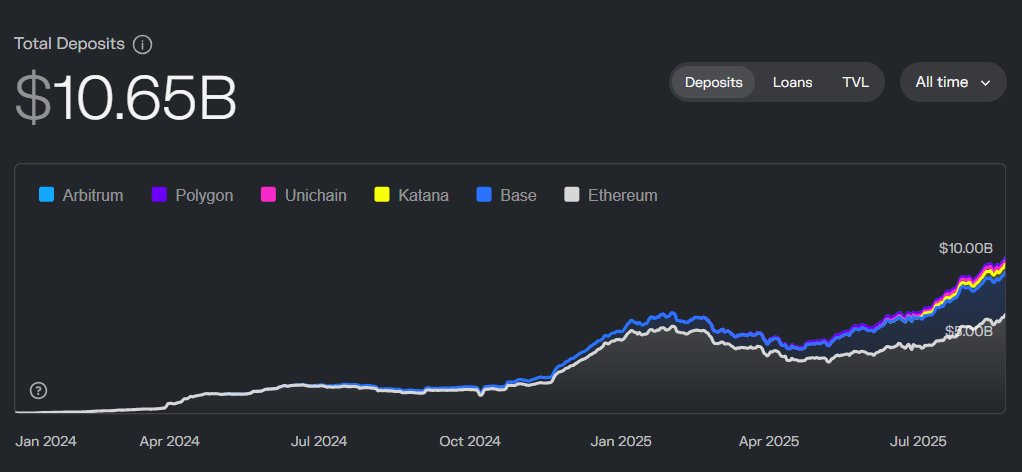

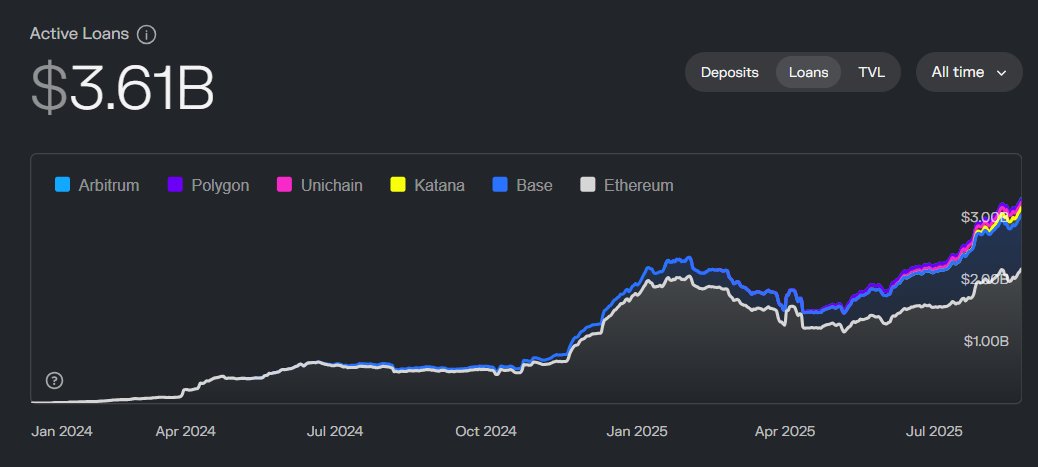

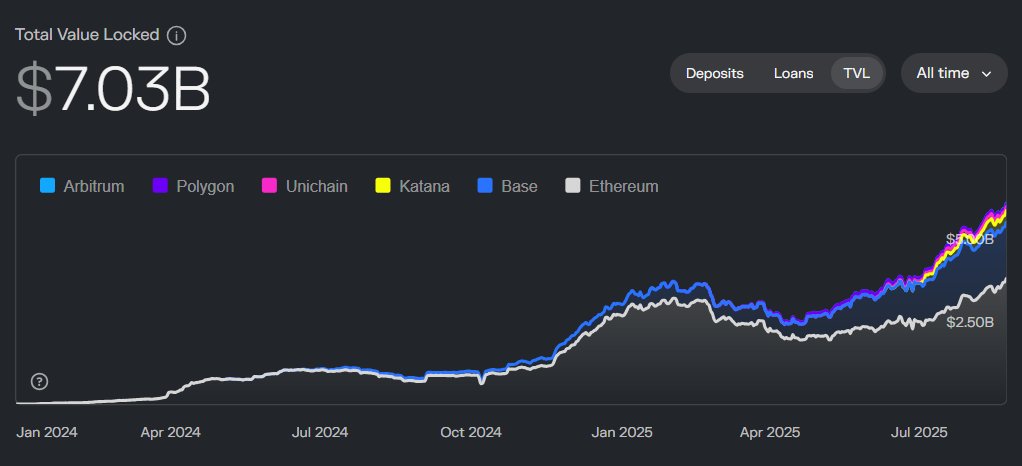

- TVL grown to $7B (+59% since last coverage), with deposits at $10.5B and loans at $3.6B.

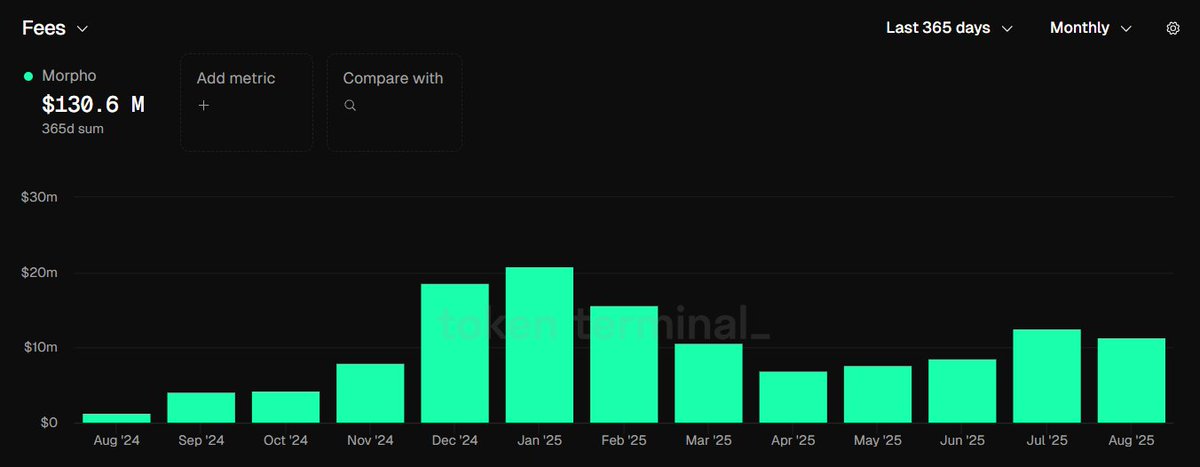

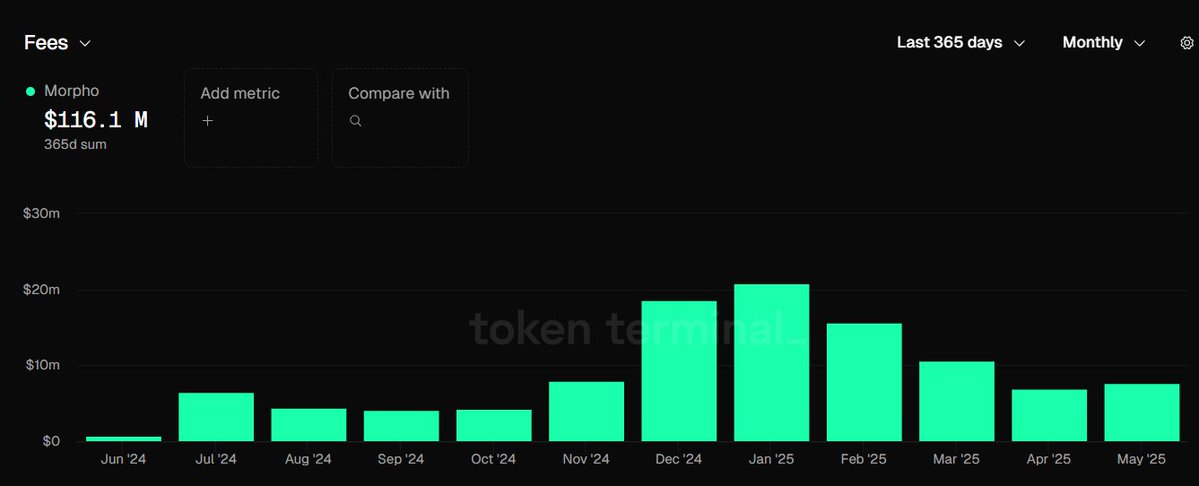

- Generating a fees of $16.4M in the last 30D vs $8.5M at last coverage; annualized run rate >$190M.

- Stablecoins and RWA collateral lead, boosted by Pendle PT/LP integrations, Hyperithm vault adoption, and Centrifuge tokenized treasuries.

- Integrations: Coinbase Stablecoin Fund placement, Gemini wallet launch, Bitpanda and LemonApp retail access, Worldcoin onboarding 500k+ users.

- Ecosystem Growth: OlympusDAO sUSDS vault live, DeFi composability expanding with Pendle and Resolv, RWA liquidity rails on Coinbase DEX and AerodromeFi.

- Forward: Morpho v2 launch imminent, fixed rate, institutional grade lending, cross chain expansion, and new primitives expected to scale far beyond current paradigm.

@MorphoLabs

1/ $MORPHO (@MorphoLabs) | $1.4B FDV (-7%/30D)

Morpho is a modular lending protocol supporting fixed-rate and crypto-backed loans across DeFi ecosystems.

Developments:

- Partnered with @TenorFinance for Morpho V2 fixed-rate lending.

- Launched mRe7YIELD collateral with @Re7Labs.

- Introduced embedded loans via @gelatonetwork.

- Grew loan from $100M to $300M in a month.

- Reached $0.5B+ in Bitcoin-backed loan collateral.

- Expanded Morpho Mini App on @worldcoin

Metrics:

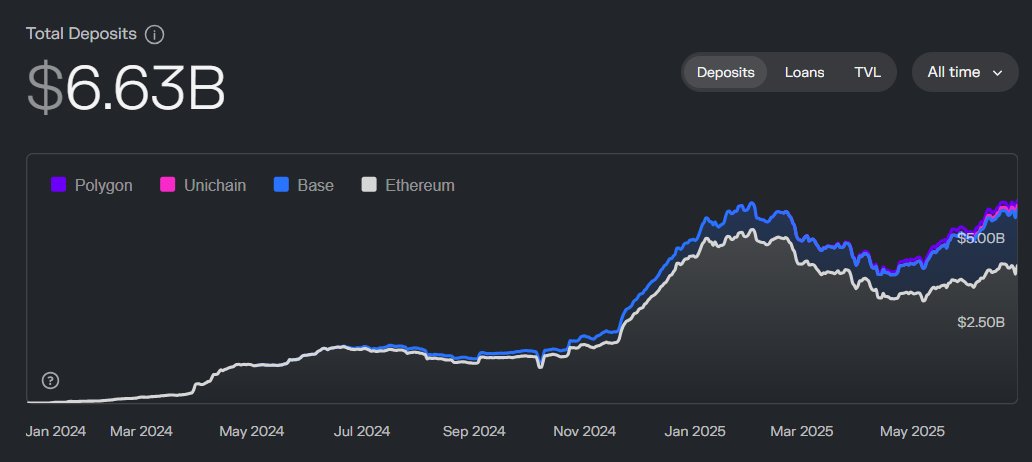

- Total Deposits: $6.5B (+25% 30d, +51% 60d).

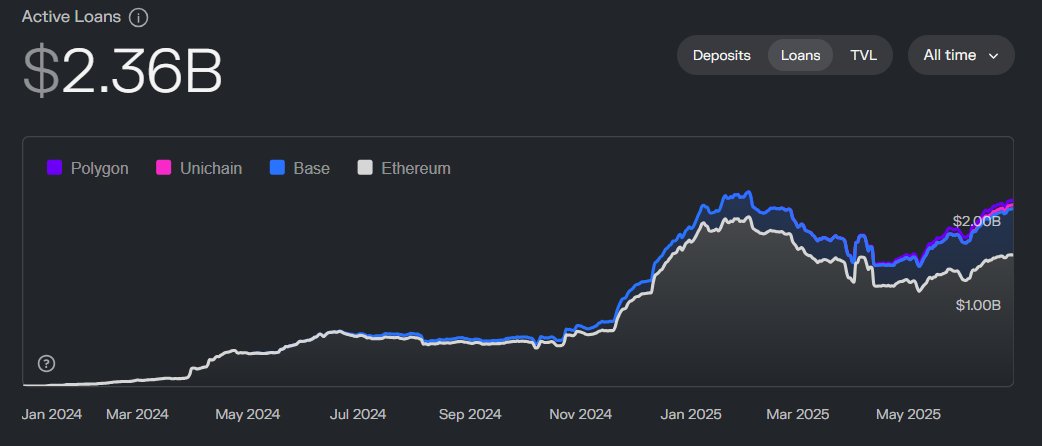

- Active Loans: $2.3B (+21% 30d, +53% 60d).

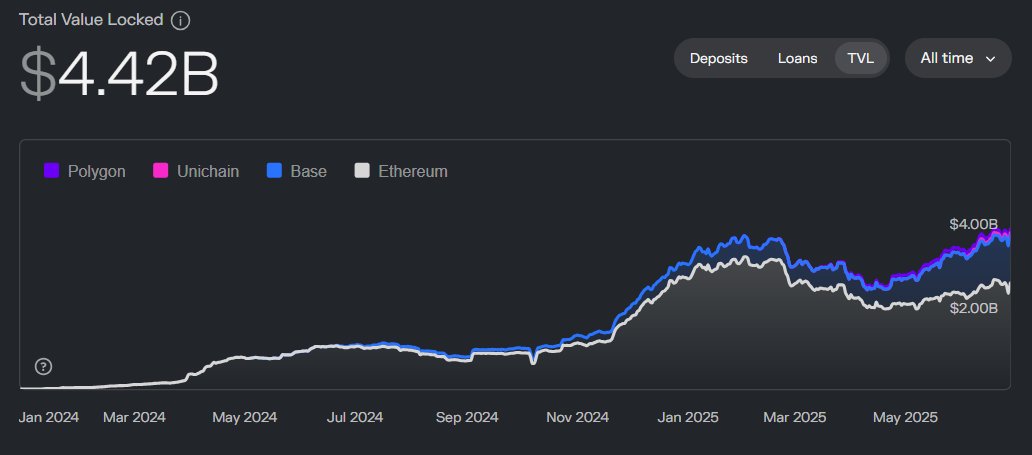

- TVL: $4.4B (+33% 30d, +63% 60d).

- Fees: $8.5M in June (+12% 30d, +21% 60d).

4.23K

3

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.