Falcon’s $FF Community Sale on @buidlpad is already over-subscribed by 2,821%.

Why that much hype?

Here’s everything you need to know about @FalconStable, its dual-token design, tokenomics and the hidden risks you should be aware of. 🧵

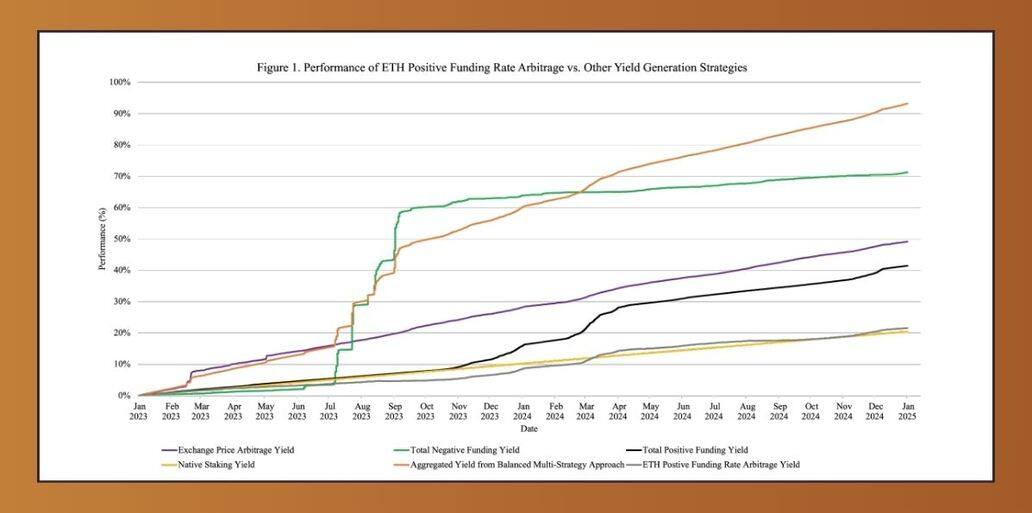

Most protocols rely only on funding rate arbitrage, which works in stable markets but fails in stress.

Falcon adds cross-exchange arbitrage, negative funding rate strategies, and staking, designed to generate yield across all conditions.

Falcon accepts more than just stablecoins.

BTC, ETH, and select altcoins are also eligible collateral.

This opens new yield opportunities, especially in staking and arbitrage, while dynamic risk controls manage liquidity exposure.

At the core is a dual-token design:

- USDf: an overcollateralized synthetic dollar

- sUSDf: a yield-bearing token that accrues yield over time

Stake USDf to mint sUSDf and let your position grow passively as yield compounds.

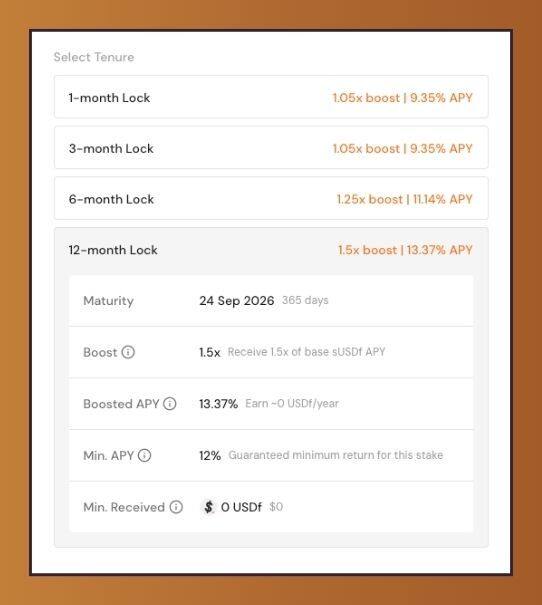

Want more yield?

Lock your sUSDf for a fixed time.

You’ll get boosted returns through special ERC-721 NFTs tied to your position.

Longer commitments unlock higher yield, rewarding those who stick with the system.

Redemption is flexible.

Stablecoin users redeem 1:1.

Non-stablecoin users reclaim collateral plus their buffer, adjusted to market prices.

The design should protect both user value and protocol integrity.

The $FF Governance Token is about to launch, giving holders voting rights and economic benefits.

Stake FF to reduce fees, boost USDf/sUSDf yields, and unlock early access to new strategies.

Governance is fully on-chain, putting the community in control.

Let's look at tokenomics:

10B $FF supply, with only ~23% liquid at TGE.

- 35% ecosystem

- 24% foundation

- 20% team (1y cliff + 3y vesting)

- 8.3% airdrops + launchpad

- 8.2% marketing

- 4.5% investors (1y cliff + 3y vesting)

Falcon’s roadmap is ambitious.

Planned for 2025: expand banking rails and launch physical gold redemption in the UAE.

In 2026: introduce tokenized bonds, private credit, and institutional-grade USDf products.

The long-term goal is to bridge DeFi and TradFi.

Falcon’s risk management is worth a closer look.

Assets are stored with custodians using MPC and multi-sig, reducing exchange risk.

Positions are monitored in real time, with double oversight to react quickly in volatile conditions.

Let's look at Falcon's transparency:

Real-time dashboards show $1.97B in reserves and a protocol backing ratio of 104%.

But 45% are held in BTC, 10+ altcoins, and only 35% in stablecoins.

This is not a reserve mix built to survive high volatility or black swan events.

BTC is volatile and cyclical.

A 20% drop could erase most of Falcon’s collateral buffer, putting USDf at risk of undercollateralization.

Altcoins like DOGE, FET, and NEAR add fragility.

In a black swan, they could drop 50%.

This risk affects the entire protocol’s solvency.

USDf is branded as a stablecoin.

But with this reserve structure, it behaves more like a high-risk yield instrument than a stablecoin.

It may perform well in normal conditions, but it’s not built for stress.

Without rebalancing toward low-volatility collateral, the risk of collapse remains.

My frens from the internet:

@crypto_linn

@Rightsideonly

@rektdiomedes

@chutoro_au

@_SmokinTed

@web3_alina

@JiraiyaReal

@GLC_Research

@yieldinator

@hzl123331

@twindoges

@poopmandefi

@CryptoShiro_

@arndxt_xo

@enijoshua_

@splinter0n

@eli5_defi

@cryptorinweb3

@Hercules_Defi

@thelearningpill

@belizardd

@0xDefiLeo

@YashasEdu

@Neoo_Nav

@0xCheeezzyyyy

@cryppinfluence

@cchungccc

19.15K

219

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.