🌬️ The payment wind is slowly starting to blow.

I've been shouting about stable stable stable -> payment payment payment since long ago, and it seems like we're gradually transitioning from stable to payment one by one.

Stripe, Bitgo, Circle, Tether, they're all working on building payment networks and foundations.

Now, as payment options are starting to emerge one by one,

it seems like some will begin to grow explosively.

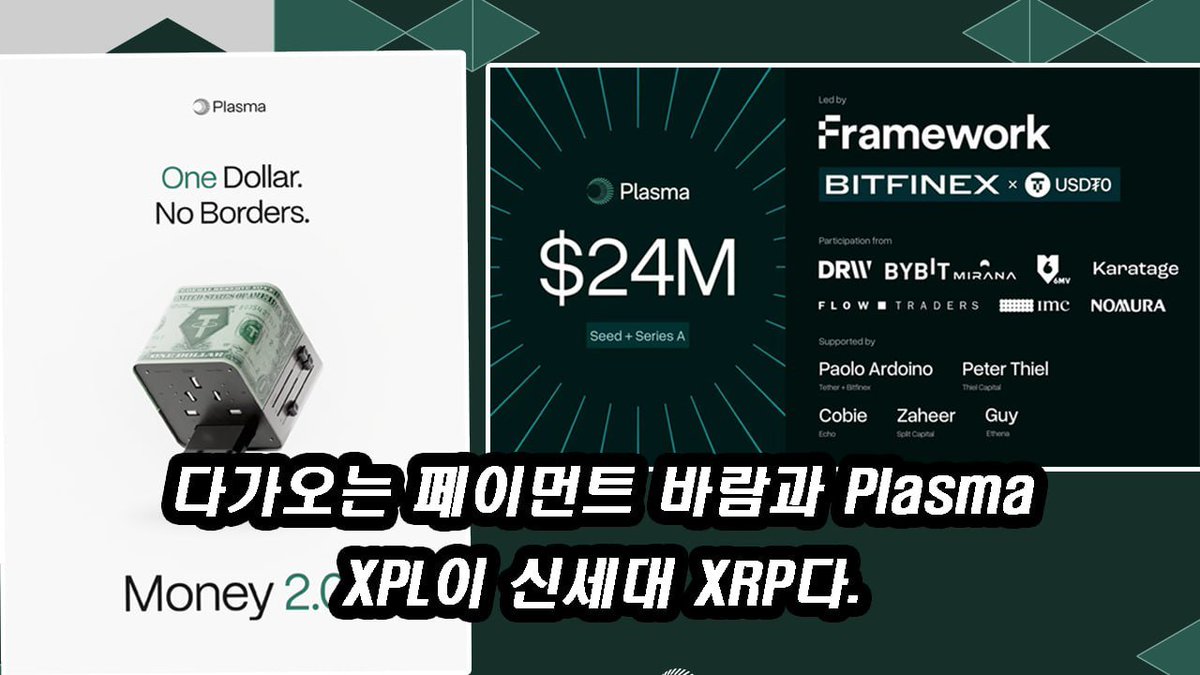

Personally, I'm mostly all-in on Plasma @PlasmaFDN.

🕊️ XPL is the new XRP.

There are many similar projects that can capture both Tether and Bitcoin, but it seems like Plasma is the only one so far.

+ Besides the institutions keeping everything for themselves, there should also be places where retail can participate.

Finally, just like how we saw projects surpassing 10 billion during the stablecoin boom,

I wonder if well-made payment apps will start to emerge one by one in the future as Dapps?

🔴🔴🔴Warning: Long Post 🔴🔴🔴

📌 With the stablecoin meta heating up, let's envision the next future (Feat. 2023 video and my personal thoughts)

📱 2023.10.20 Why are they risking everything on stablecoins? ()

📱 2023.10.20 Video on why they are risking everything on stablecoins (

What will be the next sector after the stablecoin meta?

Personally, I really like the stablecoin sector + payment sector, and I think those in the room would know this.

That's why I've been putting a lot of effort into Ethena and USUAL since mid-year, which is also why we discussed it in the room.

Anyway, by the end of 2023,

I have a video on "Why are they risking everything on stablecoins?"

So, let's bring it up again!

Well, the growth of the stablecoin market has now firmly established itself,

and as the crypto market grows, I believe the competition in stablecoins will accelerate even more.

However, compared to 2023, my thoughts have started to change quite a bit.

I no longer think of the stablecoin market as a blue ocean.

Honestly, the reason I could make such a video at the end of 2023 was that there was basically nothing in the market except for USDT, Tether, and DAI.

When I shouted that the stablecoin market is really a goldmine, it was because there were so many areas that could grow if we took the pie.

Now, however, there are too many projects issuing stablecoins through various methods like non-bond income distribution, funding fees, Basis Trading, etc.

Of course, it's not the end yet, but I think it's time to enjoy it while preparing for the next step.

So, if we ask where the next sector will be after these stablecoins have experienced tremendous growth,

I personally think that the stablecoin utilization/payment sector will be the biggest following sectors.

For stablecoin utilization, there are representative examples like stablecoin restaking, e.g., Level,

or various platforms for arbitrage trading using different stablecoins.

Above all, I think the payment sector is definitely rising to a place where it can shine.

To put it bluntly, what good is it to grow the stablecoin market?

It's not like stablecoins were created just to long and short futures and distribute interest...?

I believe stablecoins are growing to be used for direct payments, not just in crypto but in various places.

If crypto consumer apps establish themselves one by one, that would be even better,

and I think this is a process that also happens in Web2.

At first, transactions were done in cash (just trading),

then vaults and banks were created to store money, and they played with money (Tether, Circle),

soon banks and companies that give interest to people started to emerge to win in competition (ETHENA, ONDO, USUAL, etc.),

and now people are creating cards and remittance systems that allow them to receive interest without withdrawing money from banks (payment services).

A new consumer market era based on that payment system is opening up (consumer app era).

Well, this is a rather speculative opinion, but anyway, once the diversification of the stablecoin market is somewhat complete,

then I think we might see interesting projects in the payment sector, like fee distribution projects for payment systems or free transaction fees when staking tokens.

There could be even more innovative ideas, but my imagination has its limits.

I think it will be hard to imagine the payment services that will emerge.

Anyway!! Enjoy the bull market of the stablecoin market and keep an eye on payment/crypto & stablecoin payment apps for the next step.

This is a long post expressing my intention to prepare.

Hearts and likes are a great support for BQ content 🤩

#Stablecoin #Payment #USUAL #Ethena #ONDO #RWA

7.72K

12

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.